Financial Services Sector: What does ESG mean at the corporate level?

Environmental, Social and Governance (ESG) is continuing its climb up the corporate agenda – and it does not only apply for large publicly listed corporates. In this article, we cover what all financial services firms should consider when incorporating ESG at the corporate level and how to effectively structure and implement a meaningful ESG strategy.

Heily Lam, Intern

What does ESG mean for financial services firms?

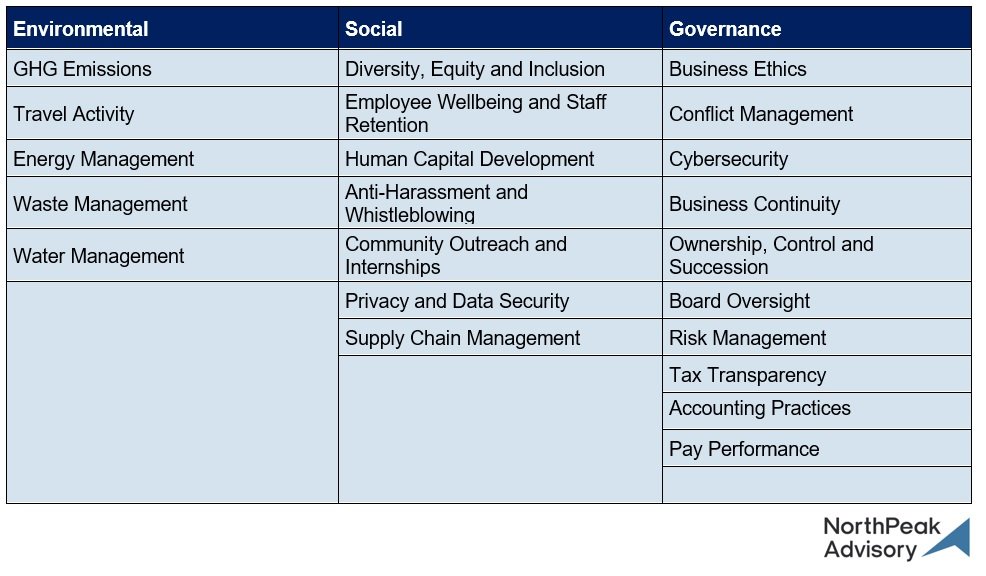

Not all ESG factors are relevant for all companies, primarily depending on firm size, location, ownership structure, and business model etc. As such, it is important for businesses to identify those factors that may be material and most important for stakeholders in order to focus resources and create valuable outcomes. Example ESG Factors

Needless to say, in the financial services industry, governance has long been in focus. Having a well-structured board, the right skills and incentives, solid accounting and reporting practices, strong cybersecurity practices, tax transparency, strong risk management frameworks are all core aspects of good governance along with a range of other topics. Similarly, having a clear approach for sustainability / ESG oversight at the firm level ensures that the overall actions and progress are worked on effectively, These structures provide the necessary oversight, process, accountability and transparency; and ultimately contribute to the firm operating effectively while being resilient and fit for the future.Since financial services firms are human capital-intensive, the long-term success hinges on cultivating a work environment that enables every employee to succeed. The social element is therefore important as it is what creates a well-functioning work environment and culture where individuals are motivated, work well together, and are given the right tools to contribute to the firms’ activity and grow professionally.Whilst human capital development and inclusion is important, another aspect to consider is data privacy and security – which can sit under the ‘S’ or the ‘G’. Having strong data protection practices is crucial, especially as firms increasingly are being targeted by hackers, resulting in heightened financial, reputational and legal risks and loss of client trust. The Global Risks Report 2022 by World Economic Forum (WEF) highlighted that malware increased by 358% from 2019 to 2020 while ransomware increased by 435%. Hackers are targeting large data-rich organisations, resulting in financial, legal and reputational burden on firms. The environmental footprint of the corporate side (i.e. not the investments) of financial services firms is relatively small compared to many other industries. This means that it may be less of a priority as part of the corporate ESG strategy, but since actions are relatively straightforward and quick to realise, all firms can do something to improve their environmental performance. For example, monitoring energy efficiency to reduce unnecessary consumption, starting to measure the firm’s carbon footprint, reviewing recycling policies, and educating / encouraging employees on how they can minimise their footprint, are all actions that are relatively straight forward to implement. The impact of these efforts may seem small, but collective action across industries and improving awareness of the responsibility to take action contributes to addressing global environmental challenges on the whole.We have summarised a few actions below that can help you frame your approach to ESG on the corporate side.Stakeholder and Materiality Assessment

Communicating with your stakeholders, including e.g., employees, investors, board members, service providers etc., is an important step in building a common ground on ESG priorities. Having senior buy-in is important since their acknowledgement and support is what defines the firm’s ability to progress to the ultimate outcomes. Materiality is key for building an ESG strategy because it helps define the topics that are important for the firm and its stakeholders. Commonly, this involves surveying both your internal and external stakeholders so that the firm can identify the overall importance of ESG issues. Here, firms tend to focus on financial materiality (i.e. impact of the issue on the firm’s financial performance), but increasingly also double materiality (including the impact of the firm on the issue). Overall, for all asset managers the focus is on what elements are material to your stakeholders.The outcome of the assessment helps prioritise the topics that the ESG strategy then should focus on. These topics should be reviewed over time as stakeholder expectations evolve.Measuring Your Current Performance

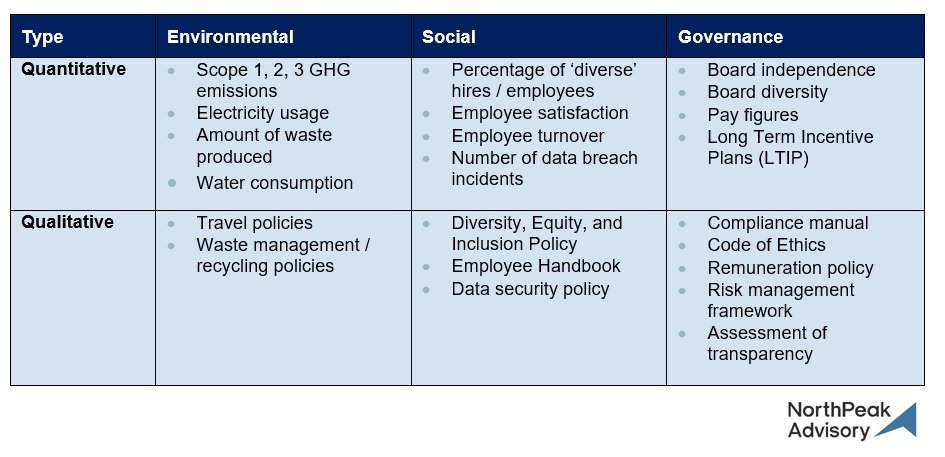

Once ESG priorities have been defined, the next step is to identify, track, and measure progress on these topics – as the saying goes “you can’t manage what you can’t measure”.Firstly, one needs to define the metrics to use. There is currently no globally agreed standard on which ESG metrics firms should disclose, but firms across the industries are voluntarily disclosing in line with reporting frameworks such as SASB and GRI, or in line with thematic initiatives such as the TCFD (which is becoming a regulatory requirement in some parts of the world). Similarly, regulators have started building disclosure requirements that soon will apply to smaller financial services firms too. For smaller asset managers, current reporting frameworks may not be as applicable due to the size of the firm, and therefore smaller asset managers are not expected to provide detailed ESG data on corporate ESG performance. However, there are still some disclosure expectations from investors on firms’ products and internal operations, which a detailed policy can answer. With increasing investor demand for ongoing ESG-related information, managers should be prepared to respond to investor requests, particularly in relation to social aspects such as DEI. As it relates to providing reporting on the portfolio characteristics this will be dependent on the investment strategy.The following table includes some common example metrics that can be helpful when assessing current ESG performance. Most data can be collected internally through coordinated processes gathering the right data, documentation and communicating with relevant parties (e.g., landlords and service providers).Example ESG Metrics

Although ascertaining an accurate figure for some of these metrics may be difficult, the goal of this exercise is to provide a clearer picture on where the firm is currently.Target Setting

Setting ambitious but realistic targets and consequent plans for the firm to work on is a way to ensure that the identified strategic ESG issues are improved over time. It helps defining the path the firms are looking to take, demonstrating the longer-term vision to stakeholders, whilst also being a mechanism for accountability. Targets should ideally be quantifiable and timebound, and firms should be transparent with the plans in place to meet targets. Importantly, the targets should not just be the prediction of future performance based on the past rate of change, but should be ambitious in order to actually improve the rate under business as usual. Since most reporting happens on an annual basis, annual targets are common, but these may need internal shorter timeframe targets in order to be realised. Reporting

Genuinely disclosing ESG progress is an important communication tool to build trust with current and future stakeholders about the firms’ commitment. It is expected that ESG reporting includes the firm’s values, ESG approach and oversight, current ESG status and achievements, and future ambitions, which can be communicated through annual reports or dedicated sustainability reports. In the current environment, with increasing scrutiny on disclosures and cases of greenwashing, firms should make sure that what is reported on actually happens on the ground, and that reporting is not done simply as a marketing exercise but instead to showcase where the firm is at the moment and where it strives to be. The same applies to the ESG approach in the investment process.Conclusion

ESG aspects are important for financial services firms to consider both in their investment process and also at the corporate level, with expectations from different stakeholders increasingly being focused on both. To date, there have been numerous initiatives from the financial sector, regardless of company size, to address common ESG issues such as climate change, diversity and inclusion, pay performance, board structures, etc., and we expect to continue seeing meaningful actions evolve. Although many ESG issues have previously been considered immaterial, these are increasingly becoming important as stakeholder expectations and regulatory requirements change. We believe that collective effort is required in solving ESG-related challenges, and would hope to see the financial sector as a whole continuing to provide transparency around values, strategies and their corresponding day-to-day actions, ambitions, and progress against the goals that have been set. Get in touch at info@northpeakadvisory.com if you would like to discuss this in more depth. We have written about the topic of ESG data and ESG skills, which you can read about in our Insights section. NorthPeak also offers online ESG training modules to support and build your teams ESG understanding and knowledge.